Released in March, the US IAB’s State of Data 2024 report gives some vital insights into the current state of the market. Above all, it shows that signal loss is the overriding trend of the year, with 95% of respondents expecting it to continue chipping away at people-based targeting.

In parallel, the report suggest that from training, to hiring, to paying for a burgeoning list of replacement tech – maintaining the status quo in the face of signal loss is translating to increased investment and overheads for businesses across the board.

“Consumer Data…to be Continually Reduced”

The survey of 500+ leaders across the market that 95% expect continued legislation and signal loss in 2024 and beyond, while 72% expect “consumer data, including browsing history, PII, and location to be continually reduced.” Alongside this, the majority (50-60%) are losing confidence in the quality of data they are receiving from social, programmatic and ad server partners alike.

The cost of maintaining business as usual against this backdrop appears to be escalating, according to the report. Over 80% of respondents say the makeup and structure of their organisations are being directly impacted by signal loss and legislation, with greater investment and hiring around data privacy especially – on staffing internal teams, external support or on training. One third of companies are now relying on, or planning to hire external legal specialists specifically due to signal loss.

The Cost of Cookie Replacements

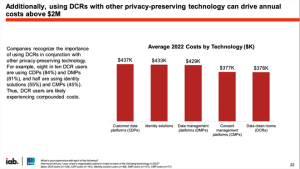

In last year’s report, the IAB had previously revealed that the cost of running cookie replacements might exceed $2m per year. This was measured based on 2022 figures, so allowing for inflation, if anything present costs may be significantly higher.

Source: IAB State of Data 2023

All of which points to another area of increased overheads in the face of signal loss – affording and relying upon a growing array of third parties in place of cookies: the IAB’s survey showing 70% plus of respondents needing or planning to invest funds in everything from analytics solutions to CDPs, DMPs and identity solutions. In the year of Chrome cookie phase-out, it is also interesting to note by comparison that less than 60% of respondents said they expected to use the alternative – Google’s Privacy Sandbox.

Source: IAB State of Data 2024

On the bright side, the report also points to investment in new solutions, without some of the legal burden mentioned elsewhere – with campaign measurement disrupted just like targeting, 76% are investing in new forms of multi-touch attribution, alongside new tech stacks based on 1st party data and AI. And finally, 66% plan to increase contextual spend in response to market changes, coming out highest in terms of increase in ad spend by tactic.