Fashion is a sector that has arguably seen a faster shift from high street, to online-only than many expected. With major chains shutting physical stores, and former ‘digital native’ brands starting to look more like the old guard. Meanwhile fast fashion brand Temu became a leader in marketing spend for the sector, reportedly spending £1bn in 2023 on Meta alone.

Nano has collated insights from its own platform and surveys to pick out four trends, reflecting the wider economy, as well as growing awareness of fashion’s environmental impact, inclusiveness and more:

1. The Rise of Vinted

Tight economic conditions have contributed to a growing interest around fashion marketplaces – especially Vinted: Nano’s own platform data indicating a 32% increase in content for the sector1.

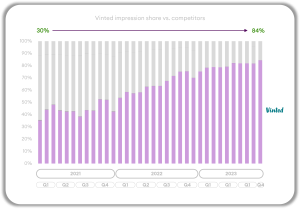

With these services, saving money and ambitions for more sustainable fashion align. And as the second-hand market becomes more competitive, investment in the market has seen staggering growth, with Vinted spending £37 million in 2022 on advertising. This spend has rocketed as their market share rose from 35% in 2021 to 84% as of October 2023.

Source: Nano Interactive impression data, UK November 2023, Ad Intel 2023

Meanwhile, 57% of people state that affordability was the main barrier to adopting an eco-conscious lifestyle, and 35% of consumers want more transparency and information on brands’ suitability credentials (Canvas8). While these marketplaces may not answer all these concerns, their appearance at the top of app store lists demonstrates their wide appeal – it would be interesting to note whose business they are eating into.

2. Investing in Luxury

The ‘lipstick effect’ is well underway. Consumers are arguably still purchasing luxury goods in-spite of the economic downturn – just cheaper ones. Firms like Deloitte have highlighted sales in luxury goods above pre-pandemic levels, up 13% in 2022, from $305B to $347B.

60% of Gen Z have made a luxury purchase in the last 12 months versus just 18% for Boomers (Canvas8). And a greater interest in luxury fashion among younger audiences is reflected elsewhere too.

Source: UK (N=510), Nano Interactive Panel Research, December 2023

Luxury fashion buying is unsurprisingly most widespread among high earners. And across all tiers, it’s interesting to note people claim craftsmanship is a greater pull than brand prestige here. What might surprise even more is that the lowest spending tier, 72% are still active buyers in this category. Meaning that most of the market is addressable across annual income tiers:

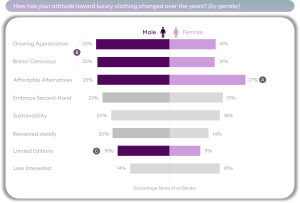

When looking at a gender split view on luxury, we found both male and female respondents strongly found their preferences shift towards affordable alternatives in time, which may of course be influenced by the financial climate.

More than a quarter of all males also appear to have a growing appreciation for luxury clothing as they get older. This trend also extends to their being more ‘brand-conscious’ in time, with 25% of males stating this has increased. Arguably, reaching male consumers has grown as an opportunity for luxury clothing brands. Limited editions are significantly more popular among males, likely driven by brands such as Supreme and sneaker culture.

Source: UK (N=510), Nano Interactive Panel Research, December 2023

3. Attire For All

There is a growing trend around a share of consumers seeking brands to authentically embed inclusivity into their ethos, addressing body positivity and gender neutrality.

57% of consumers are more loyal to brands that commit to addressing social inequalities. While 44% of Gen Z value concepts such as “being comfortable in your own skin” and “inner confidence” compared to other generations (Canvas8).

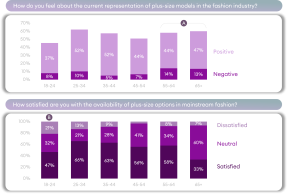

As seen below, younger age groups currently feel the least satisfied with plus-size fashion options:

Source: UK (N=510), Nano Interactive Panel Research, December 2023

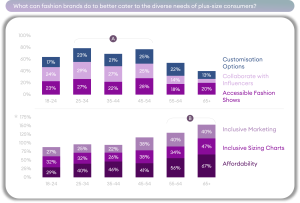

Those between 25-54 all would like to see more influencer collaborations and accessible fashion shows.

Older generations think better affordability is needed within the plus-size market, most of all among the 65+ age group. Demand for better inclusive sizing charts and marketing also increased with age, suggesting older generations may be seeing less focus from brands in this area:

Source: UK (N=510), Nano Interactive Panel Research, December 2023

4. Immersive Experiences

This trend sees brands looking to provide unique and immersive experiences to entice consumers back to physical shops.

85% of people say they enjoy traditional brands going in unexpected creative directions (Canvas8). On that note, Gucci marked its 100th anniversary by creating an immersive experience that focused on redefining luxury, mixing retail and leisure, as well as music and London’s creative community. This activation resulted in over 1,500 new client prospects, and over €1m in sales.

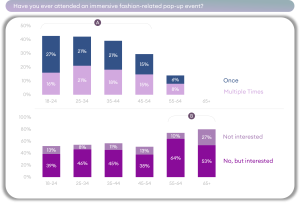

Such immersive experiences have broad appeal, with the 18-34 demographic most likely to engage:

Source: UK (N=510), Nano Interactive Panel Research, December 2023

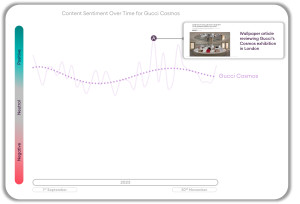

General sentiment for content mentioning Gucci’s Cosmos exhibition at London’s 180 Studios was positive, which only improved following its launch. Positive reviews of the exhibition by publications such as Wallpaper after the launch contributed to the increase in positive sentiment during its duration:

Source: Nano Interactive impression data, UK November 2023